The heart of financial markets is certainly charts. Understanding

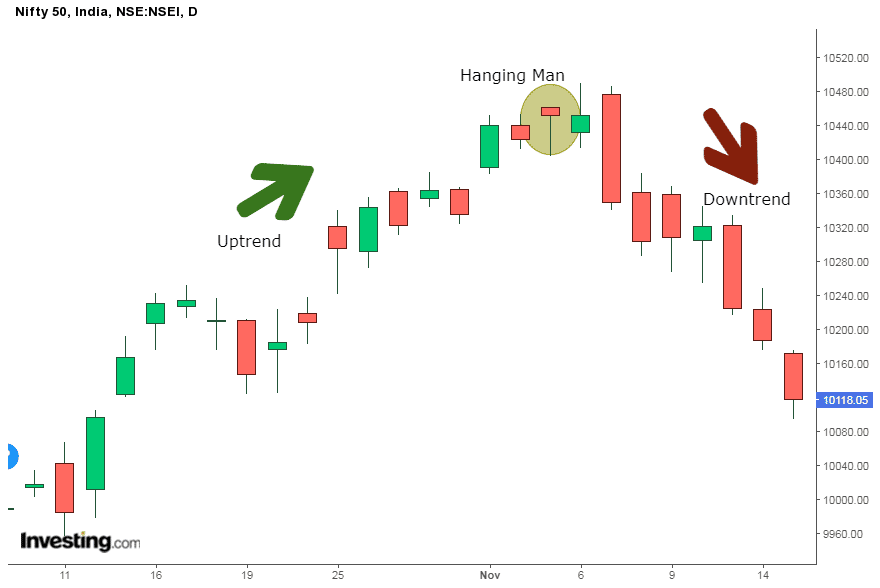

A "hanging man candlestick pattern" is a single candlestick that needs a follow-through candlestick after it to show negativity. In other words, while it is a single candlestick, you need the market to confirm it. The candlestick will often show the overall trend rolling over in an uptrend.

PBInvesting on Twitter "2. Hanging Man Candle Prior Uptrend Short

Hanging man or hangman candlestick refers to a bearish single-candlestick formation found at the topmost point of an uptrend. Traders utilize this pattern in the trend direction of pattern changes. It also signals the trend reversal of the market as soon as the bull appears to lose its momentum.

Pin on Chart AnaLyst

Chart Patterns Hanging Man Pattern Hanging Man: A Bearish Reversal Single Candlestick Pattern: Guide Price reversals are a common occurrence while trading stocks, commodities, currencies, and other instruments in the financial market.

.jpg)

FileHanging Man 2 (2541570456).jpg Wikimedia Commons

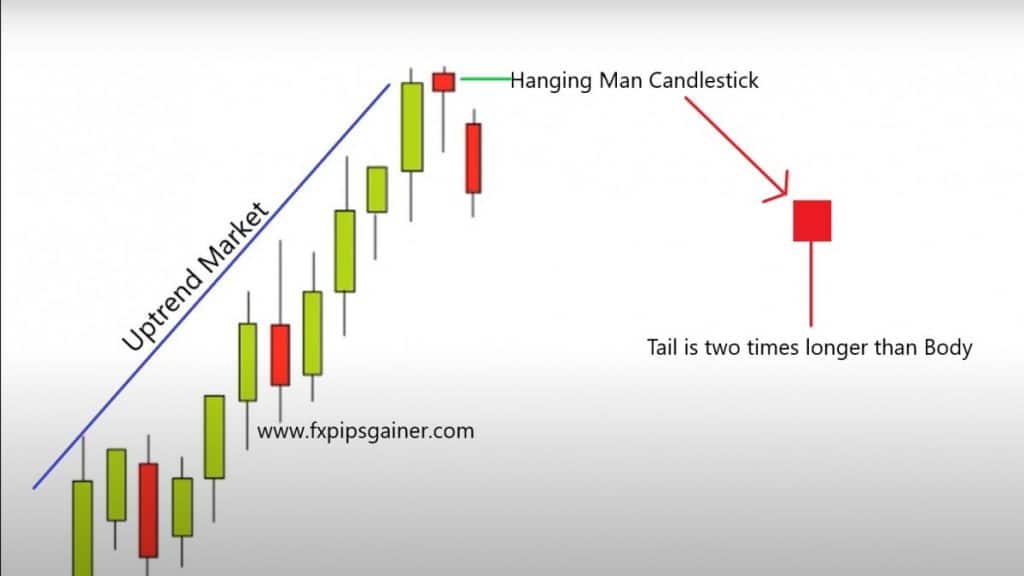

The Hanging Man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. The following features characterize it: A long lower shadow or 'wick', at least two or three times the length of the real body. A small real body (the difference between the open and close prices) at the upper end of the.

Hanging Man Candlestick Forex Trading

The hanging man occurs when two main criteria are present: The asset has been in an uptrend. The candle has a small real body (distance between open and close) and a long lower shadow. There is little to no upper shadow. Given these two criteria, when a hanging man forms in an uptrend, it indicates that buyers have lost their strength.

Mô hình nến Người Treo Cổ Hanging Man Pattern là gì? Sống Để Trade

What Hanging Man Signifies in an Uptrend. The appearance of a Hanging Man during an uptrend signals that sellers are starting to enter the market, which may lead to a price decline. This pattern is viewed as a potential bearish reversal signal. The Concept of Confirmation. Confirmation is a critical concept in candlestick pattern analysis.

Hanging Man Candlestick Pattern Complete Overview, Example

The Hanging Man is a bearish signal indicating that the prior uptrend is about to end and may reverse to a downtrend or move sideways. This pattern is an indication of a financial instrument's SHORT-TERM outlook. Description. The name "Hanging Man" is used because it has a gloomy connotation, and also because the candlestick that defines this.

The hanging man candlestick pattern represents a potential reversal

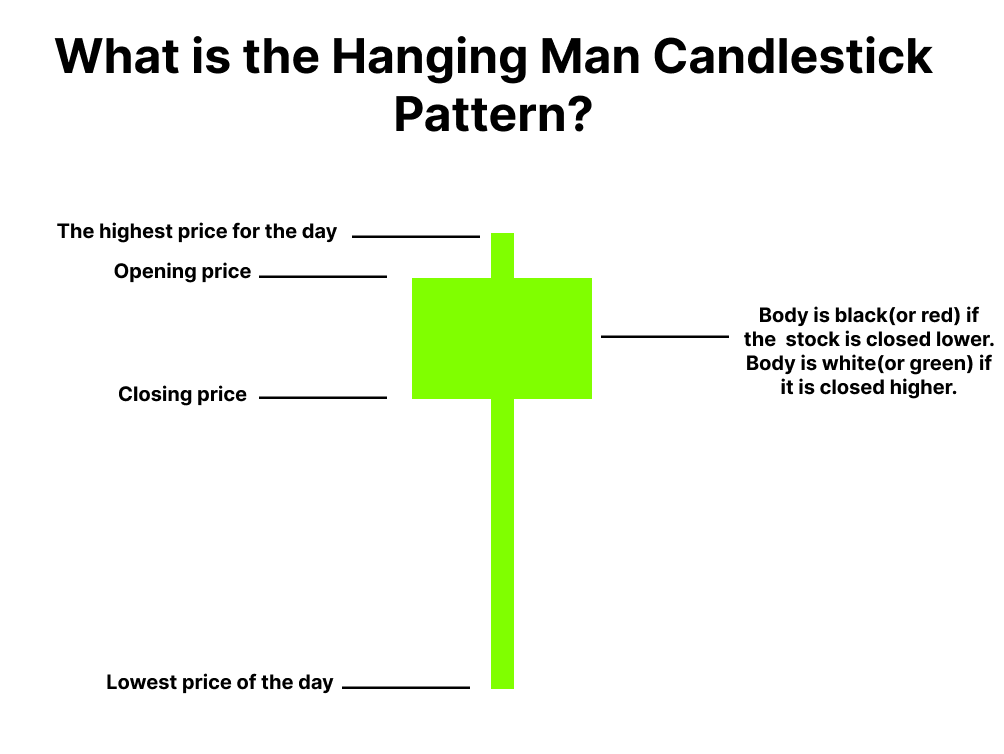

The hanging man indicates the weakness of an uptrend. The pattern has a unique shape. A small body with a long tail beneath it. The pattern can be both a bullish candle or a bearish candle. Hanging Man Candlestick Features: Let's start with the characteristics that define the hanging man candlestick. Below is a picture of the candlestick pattern.

Hanging Man Candlestick Forex Trading

A hanging man is a single candlestick pattern that forms after an uptrend. It's a reversal pattern, which means that it's believed to precede a market downturn. As to the characteristics of the hanging man pattern, its body is small, and confined to the upper half of the range, with a long wick to the downside.

/dotdash_Final_Hanging_Man_Candlestick_Definition_and_Tactics_Nov_2020-01-0a9ec4d589e7421783e202dc28a6ec85.jpg)

Hanging Man Candlestick

Updated December 14, 2023 Reviewed by Charles Potters Image by Julie Bang © Investopedia 2019 What is a Hanging Man Candlestick? A hanging man candlestick occurs during an uptrend and warns.

Hanging Man Candlestick Pattern Best Analysis

Hanging Man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. This candlestick pattern appears at the end of the uptrend indicating weakness in further price movement. It is formed when the bulls have pushed the prices up and now they are not able to push further.

KOTAKBANK BEARISH HANGING MAN CANDLESTICK PATTERN » EQSIS PRO

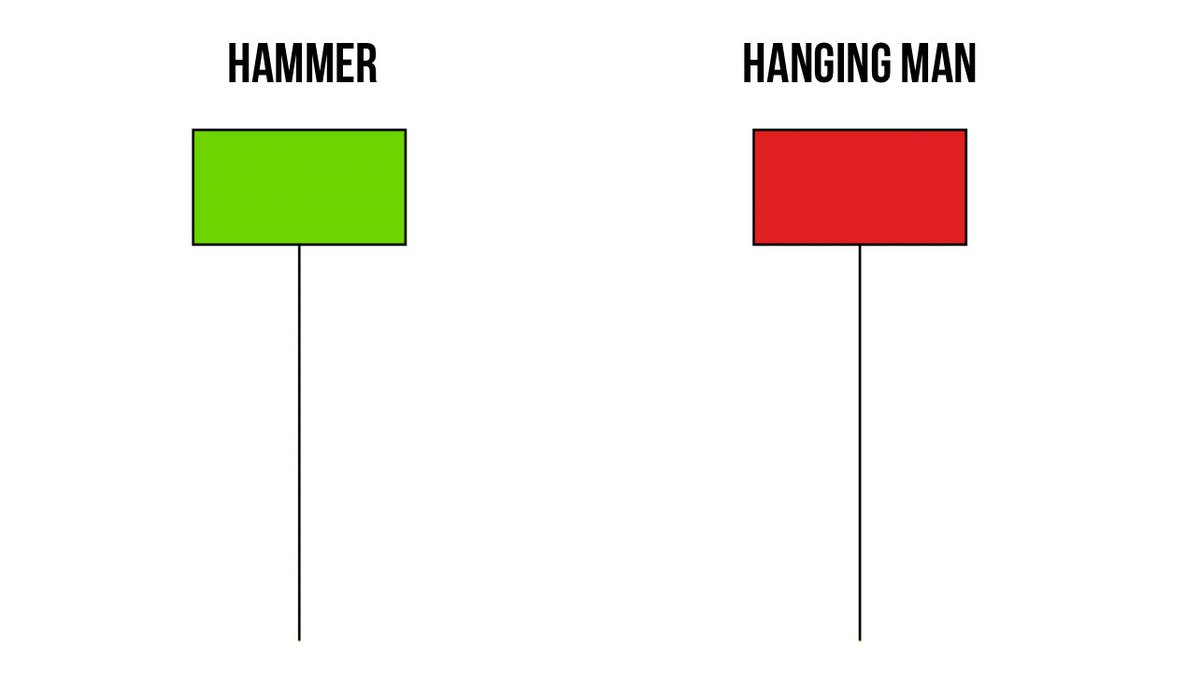

The hanging man is Japanese candlestick pattern that appears in uptrends. It can in some circumstances be a sign that a trend is about to reverse. It is closely related to the hammer, inverted hammer, and the shooting star pattern. How to Identify a Hanging Man

Stock Trading Strategy for Hanging Man Candlestick Pattern

The hanging man is a Japanese candlestick pattern that signals the reversal of an uptrend. This article will cover identifying, interpreting, and trading the hanging man. Table of Contents What is the hanging man candlestick? How to identify and use the hanging man candlestick? Hanging man vs. hammer candlesticks

The hanging man Exibart Street

A hanging man candlestick occurs during an uptrend and warns that prices may start falling. The candle is composed of a small real body, a long lower shadow, and little or no upper shadow. The hanging man shows that selling interest is starting to increase. In order for the pattern to be valid, the candle following the hanging.

Hanging Man A Bearish Reversal Candlestick Chart Pattern

The Hanging Man pattern is a bearish trend reversal pattern that consists of a single umbrella line. It is a candlestick with a short real body, a long lower shadow and little or no upper shadow. When the umbrella line appears in an uptrend then it is called the Hanging Man pattern. Learn how to identify, understand and trade the Hanging Man pattern.

What Is Hanging Man Pattern & How to Trade Using It Finschool

The Hanging Man pattern is primarily considered a warning sign for traders, hinting at a possible reversal of the uptrend. However, it is crucial to note that this pattern alone does not initiate a sell signal. Instead, it sets the stage for a potential bearish reversal, which is confirmed by subsequent price action.